Preliminary results for the year ended 31 December 2025

PRESS RELEASE

12 FEBRUARY 2026

Preliminary results for the year ended 31 December 2025

Momentum Drives Further Confidence in 2026 Delivery

Tadeu Marroco, Chief Executive

“I am pleased with our accelerating momentum through 2025, enabling full-year delivery at the top end of our guidance. This reinforces our confidence in sustainably delivering our mid-term algorithm from 2026.

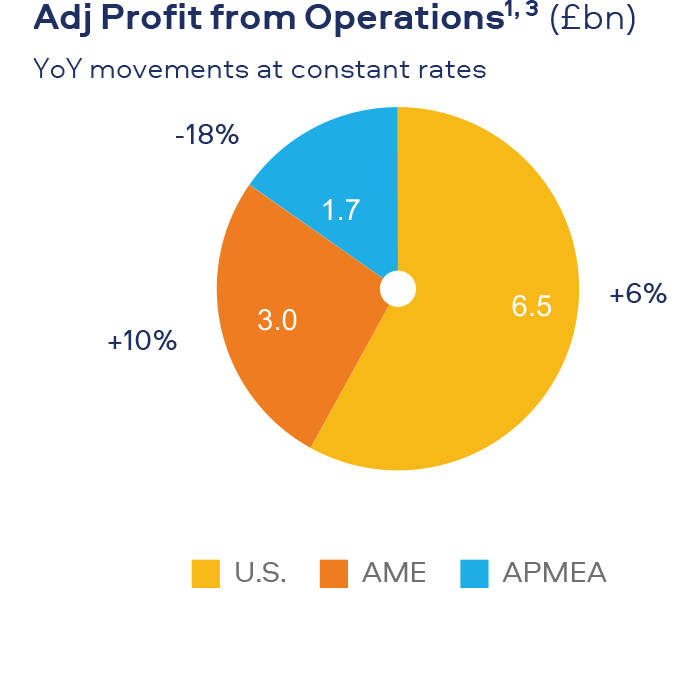

Our U.S. business has delivered strong growth, mainly driven by sustained momentum in combustibles, resulting from our commercial actions and enhanced execution. Velo Plus has delivered excellent results with triple-digit revenue growth, with Velo reaching the number 2 position in volume and value share and achieving category contribution profitability within one year of launch. The recent improvement in Vuse performance is encouraging, although the Vapour category continues to be impacted by illicit proliferation. Over time, we believe Vuse is well positioned to benefit from stronger enforcement at the Federal and State level.

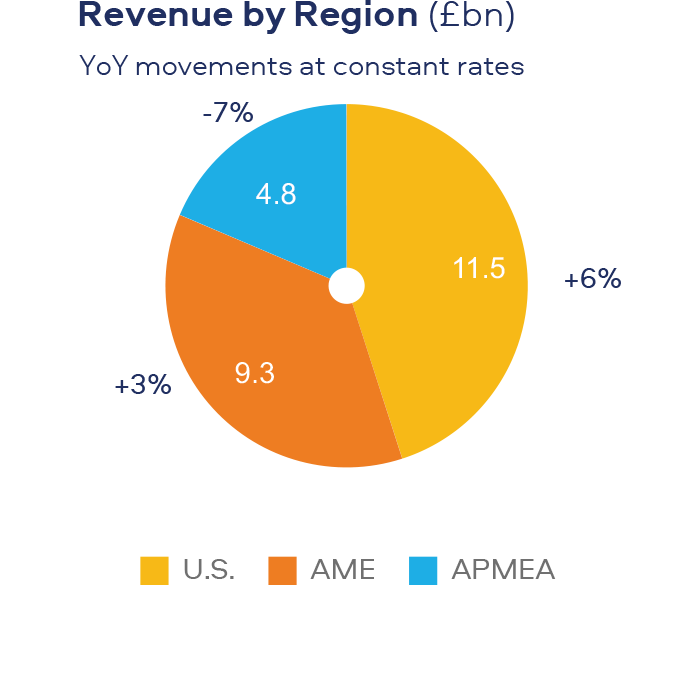

In AME, our multi-category portfolio continued to perform strongly, while our performance in APMEA was impacted by fiscal and regulatory challenges in Bangladesh and Australia.

Our New Categories revenue is accelerating, returning to double-digit growth in H2, driven by strong Velo growth in all regions. We continue to prioritise accelerating growth in category contribution through investment in our most profitable markets.

Our enhanced R&D capabilities have enabled three premium innovation launches – Vuse Ultra, glo Hilo and Velo Shift, with encouraging early results and further targeted roll-outs planned in 2026. With this momentum, together with resilient combustibles delivery and further productivity initiatives, we are confident in sustainably delivering on our financial algorithm of +3-5% revenue2, +4-6% APFO1,2,3 and +5-8% adjusted diluted EPS1,2,3, with 2026 expected to be at the lower end of the range, as we continue to invest in our transformation.

Our strong cash flow is driving increased financial flexibility and we expect to be within our 2.0-2.5x target leverage range by end 2026.

I remain committed to delivering sustainable shareholder value through robust cash returns, with progressive dividends and sustainable share buy-backs, including £1.3 billion programme for 2026."

Summary

- Added 4.7 million consumers (to 34.1 million) of our Smokeless brands

- Smokeless products now 18.2% of Group revenue, up 70 bps vs FY24

- Reported revenue down 1.0% (due to currency headwinds), up 2.1% at constant FX, driven by combustibles and Velo Plus in the U.S. and continued multi-category growth in AME, partly offset by APMEA

- New Categories revenue growth accelerated to double-digits in H2, with FY growth of 7.0%2

- New Categories contribution2 increased by 77.1% to £442 million, driven by our Quality Growth approach

- Improved combustibles revenue and category contribution2,3 driven by the U.S. and AME

- Reported profit from operations up 265% (with reported operating margin up 28.4 ppts to 39.0%), largely due to the movement in the Canadian settlement provision

- Adjusted profit from operations1,2,3 up 2.3%, adjusted operating margin1,2,3 at 44.0% (flat vs FY24)

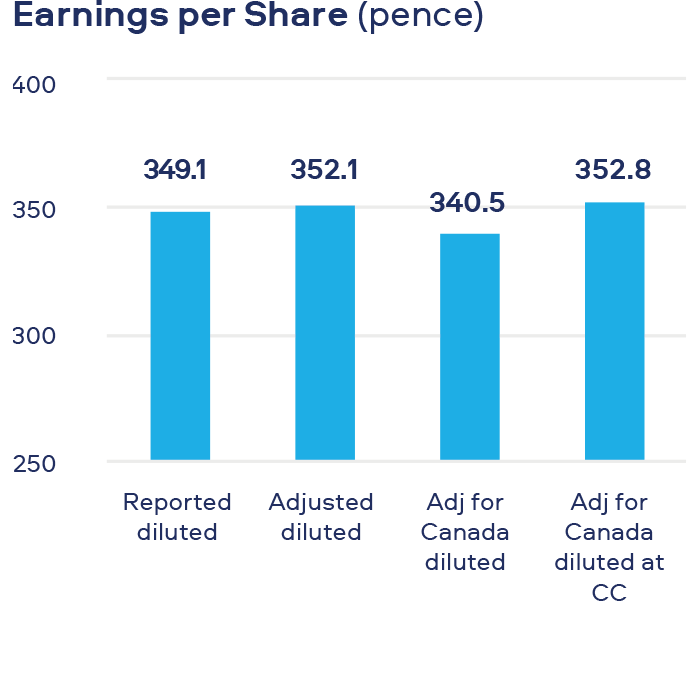

- Reported diluted EPS up 157% to 349.1p, with adjusted diluted EPS1, 2,3 up 3.4%

- Confident in sustainably delivering mid-term growth algorithm, 2026 performance expected at the lower end of the range

- On track to reduce leverage3 to within 2.0-2.5x by end 2026, supported by continued strong cash conversion

- Dividend growth of 2.0% to 245.04p and a £1.3 billion share buy-back in 2026

Change in Group Revenue:

| Reported | -1.0% |

| At CC2 | +2.1% |

Change in Profit from Operations:

| Reported | +265% |

| APFO1,3 at CC2 | +2.3% |

Change in Group diluted EPS:

| Reported | +157% |

| Adj1 at CC2 | +0.7% |

| As adj for Canada1,3 | -0.2% |

| As adj for Canada1,3 at CC2 | +3.4% |

Notes

1. Adjusting items represent certain items which the Group considers distinctive based upon their size, nature or incidence - see pages 23 to 30 of the full announcement.

2. Presented on a constant currency (CC) basis.

3. As adjusted for Canada - adjusted for the performance of the Canadian business (excluding New Categories).

Performance highlights

For year ended 31 December 2025

| Reported | Adjusted3 | Adjusted3 for Canada4 | ||||

|---|---|---|---|---|---|---|

| Current rates |

vs 2024 (current) |

Current rates |

vs 2024 (constant) |

Current rates |

vs 2024 (constant) |

|

| Cigarette and HP volume share1 | -40 bps | |||||

| Cigarette and HP value share1 | -10 bps | |||||

| Consumers of Smokeless products2 | 34.1m | +4.7m | ||||

| Revenue (£m) | £25,610m | -1.0% | £25,610m | +2.1% | £25,610m | +2.1% |

| Revenue from New Categories (£m) | £3,621m | +5.5% | £3,621m | +7.0% | £3,621m | +7.0% |

| Smokeless revenue as a % of total revenue (%) | 18.2% | +70 bps | ||||

| Profit from operations (£m) | £9,997m | +265% | £11,572m | +0.4% | £11,279m | +2.3% |

| Adjusted gross profit growth (%) | +2.1% | +3.4% | ||||

| Category contribution - New Categories (£m) | £427m | +77.1% | £427m | +77.1% | ||

| Category contribution margin - New Categories (%) | 11.8% | 4.7 ppts | 11.8% | 4.7 ppts | ||

| Operating margin (%) | 39.0% | +28.4 ppts | 45.2% | -80 bps | 44.0% | flat |

| Diluted earnings per share (pence) | 349.1p | +157% | 352.1p | +0.7% | 340.5p | +3.4% |

| Net cash generated from operating activities (£m) | £6,342m | -37.4% | ||||

| Free cash (before payment of dividend) (£m) | £4,048m | -48.8% | ||||

| Adjusted cash generated from operations (£m)5 | £6,882m | -5.5% | ||||

| Cash conversion (%) | +63% | -307 ppts | +100% | -50 bps | ||

| Borrowings including lease liabilities (£m) | £35,070m | -5.1% | ||||

| Adjusted net debt to adjusted EBITDA ratio | 2.48x | +0.05x | 2.55x | -0.20x | ||

| Dividend per share (pence) | 245.04 | +2.0% | ||||

The use of non-GAAP measures, including adjusting items and constant currencies, are further discussed from page 46 of the full announcement, with reconciliations from the most comparable IFRS measure provided.

Notes:

1. To better reflect the evolving performance of each category, from 1 January 2026 the Group will decouple the value share and volume share metrics from a combined Cigarettes and HP view to disclose Cigarettes and HP performance separately.

2. Internal estimate. See page 40 of the full announcement.

3. See page 23 of the full announcement for a discussion on adjusting items.

4. As adjusted for Canada excludes the performance of the Canadian business (excluding New Categories) given the requirement to use the profits earned to settle the litigation liability - see page 14 of the full announcement. There is no adjustment to revenue.

5. 2025 was negatively impacted by deferral of tax in the U.S. from 2024 of £678 million, the benefit of which was excluded in the 2024 comparator. Excluding the deferral from 2025, adjusted cash generated from operations would have been £7,560 million, or £7,840 million at constant rates of exchange in 2025 compared to £7,554 million in 2024.

2026 Outlook

- Global cigarette industry volume expected to be down c.2%.

- Lower end of our medium-term guidance ranges:

- 3-5% revenue1 growth, with low double-digit New Category revenue growth1.

- 4-6% adjusted profit from operations growth1,2 - H2 weighted.

- Expected c.1% transactional FX headwind.

- 5-8% adjusted diluted EPS growth1,2 growth.

- We expect a translational FX headwind of c.3% on adjusted diluted EPS growth2.

- Net finance costs1,2 expected to be c.£1.8 billion, subject to interest rate volatility.

- Gross capital expenditure in 2026 of approximately £750 million.

- Operating cash flow conversion that exceeds 95%.

- Leverage within our 2.0-2.5x adjusted net debt/adjusted EBITDA2 corridor by year end.

- Commitment to dividend growth in sterling terms and £1.3 billion share buy-back.

Notes

1. At constant rates of exchange.

2. As adjusted for Canada.

Forward looking statements and other matters

This announcement contains certain forward-looking statements, including "forward-looking" statements made within the meaning of the U.S. Private Securities Litigation Reform Act of 1995.

In particular, these forward-looking statements include, among other statements, statements regarding the Group's future financial performance, planned product launches and future regulatory developments and business objectives (including with respect to sustainability and other environmental, social and governance matters), as well as: (i) in the heading Momentum Drives Further Confidence in 2026 Delivery, the Summary and the Tadeu Marroco, Chief Executive section (all on page 1 of the full announcement); (ii) certain statements in the 2026 Outlook (on page 2 of the full announcement); (iii) certain statements in the Regional Review section (pages 5 to 7 of the full announcement) including our belief that Vuse will benefit as the authorities continue with enforcement initiatives in 2026 in the U.S. and our expectation of a wider roll-out of glo Hilo in the AME region; (iv) certain statements in the Category Performance Review (pages 8 to 9 of the full announcement), including our encouragement by the early performance of Vuse Ultra in certain markets; (v) certain statements in the Other Financial Information section (pages 10 to 13 of the full announcement), including Cash flow; (vi) certain statements in the Sustainability Performance Update section (page 13 of the full announcement); (vii) certain statements in the Other Information section (pages 13 to 16 of the full announcement), including Operational and process review, the Group's expectation to close the sale of its Cuban subsidiary and the Group's expectation to continue as a going concern; (viii) certain statements in the Notes to the Financial Statements section (pages 24 to 38 of the full announcement), including Accounting policies and basis of preparation, the Group's forecast and assumptions with respect to impairment testing under amortisation and impairment of trademarks and similar intangibles and impairment of goodwill, the Group's expected capital expenditure, the Group's targeted credit ratings and Contingent liabilities and financial commitments sections; (ix) certain statements in the Other Information section (pages 39 to 41 of the full announcement); and (x) certain statements related to dividends (page 44 of the full announcement).

These statements are often, but not always, made through the use of words or phrases such as "believe," "anticipate," "could," "may," "would," "should," "intend," "plan," "potential," "predict," "will," "expect," "estimate," "project," "positioned," "strategy," "outlook," "target," "being confident" and similar expressions. These include statements regarding our intentions, beliefs or current expectations concerning, amongst other things, our results of operations, financial condition, liquidity, prospects, growth, strategies and the economic and business circumstances occurring from time to time in the countries and markets in which the British American Tobacco Group (the “Group”) operates.

All such forward-looking statements involve estimates and assumptions that are subject to risks, uncertainties and other factors. It is believed that the expectations reflected in this announcement are reasonable, but they may be affected by a wide range of variables that could cause actual results and performance to differ materially from those currently anticipated. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking statements are uncertainties related to the following: the impact of increased competition from illicit trade and illegal products; changes or differences in domestic or international economic or political conditions; the impact of adverse domestic or international legislation and regulation of tobacco, New Categories and other regulation; the impact of supply chain disruptions; adverse litigation and external investigations and dispute outcomes and the effect of such outcomes on the Group’s financial condition; the impact of significant increases or structural changes in tobacco, nicotine and New Categories related taxes; the inability to develop, commercialise and deliver the Group’s New Categories strategy; adverse decisions by domestic or international regulatory bodies, including disputed taxes, interest and penalties; the impact of serious injury, illness or death in the workplace and those who work with the business; the ability to maintain credit ratings and to fund the business under the current capital structure; translational and transactional foreign exchange rate exposure; direct and indirect adverse impacts associated with climate change (both physical and transition); the ability to deliver a viable circular business model in response to global demand, combined with increasing regulatory, stakeholder and consumer pressure; and the Group’s ability to defend against Cyber & Digital actions that result in loss of confidentiality, availability or integrity of systems and data.

A review of the reasons why actual results and developments may differ materially from the expectations disclosed or implied within forward-looking statements can be found by referring to the information contained under the headings “Cautionary statement”, "Group Principal Risks" and "Group Risk Factors" in the Group's 2024 Annual Report and the Group's Annual Report on Form 20-F of British American Tobacco p.l.c. (BAT). Additional information concerning these and other factors can be found in BAT's filings with the U.S. Securities and Exchange Commission (SEC), including the Group's Annual Report on Form 20-F and Current Reports on Form 6-K, which may be obtained free of charge at the SEC's website, www.sec.gov and BAT’s Annual Reports.

No statement in this announcement is intended to be a profit forecast and no statement in this communication should be interpreted to mean that earnings per share of BAT for the current or future financial years would necessarily match or exceed the historical published earnings per share of BAT. Past performance is no guide to future performance and persons needing advice should consult an independent financial adviser. The forward-looking statements reflect knowledge and information available at the date of preparation of this announcement and the Group undertakes no obligation to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise. Readers are cautioned not to place undue reliance on such forward-looking statements.

All financial statements and financial information provided by or with respect to the U.S. or Reynolds American are initially prepared on the basis of U.S. GAAP and constitute the primary financial statements or financial records of the U.S./Reynolds American. This financial information is then converted to International Financial Reporting Standards as issued by the IASB and as adopted for use in the UK (IFRS) for the purpose of consolidation within the results of the Group. To the extent any such financial information provided in this announcement relates to the U.S. or Reynolds American it is provided as an explanation of, or supplement to, Reynolds American’s primary U.S. GAAP based financial statements and information.

Products sold in the U.S., including Vuse, Velo, Grizzly, Kodiak, and Camel Snus, are subject to FDA regulation and no reduced-risk claims will be made as to these products without agency clearance.

For further information, please contact:

Media Centre

+44 (0) 20 7845 2888 (24 hours) | media_centre@bat.com | @BATplc

Investor Relations

Victoria Buxton: +44 (0)20 7845 2012

Amy Chamberlain: +44 (0)20 7845 1124

John Harney: +44 (0)20 7845 1263

ir_team@bat.com