Key markets

Argentina, Brazil, Canada, Chile, Colombia, Mexico

British American Tobacco (BAT) is one of the world’s leading consumer goods companies, with brands sold around the globe. We employ over 55,000 people globally, partner with over 90,000 farmers and have factories in 42 countries, with offices in even more.

At BAT, we have been satisfying consumers, delivering shareholder value and creating valued employment for over a century.

However, we are entering the most dynamic period of change our industry has ever encountered.

An unprecedented confluence of technology, societal change and public health awareness has created a unique opportunity: the opportunity to make a substantial leap forward in our long-held ambition to provide our consumers with lower risk tobacco and nicotine choices.

Our acquisition of Reynolds American Inc. (Reynolds American or RAI), which has transformed both the scale and geographic reach of our business and our portfolio of potentially reduced-risk products, now positions us perfectly to capitalise on this ambition.

We call this ambition ‘transforming tobacco’ and we are fully committed to leading this transformation.

The advent of new and better consumer technologies meant that, in 2012, we articulated a new vision – to be the best at satisfying consumer moments in “tobacco and beyond” – with consumers right at the centre of our strategy.

We were clear then, as we are now, that we would build our business based on outstanding products, informed consumer choice and a drive towards a reduced-risk portfolio. More choice, more innovation, less risk.

It is widely accepted that most of the harm associated with tobacco is caused by inhaling the smoke produced by the combustion of tobacco. That is why we are dedicated to the development and sale of a range of potentially reduced-risk products that provide the enjoyment of smoking without burning tobacco.

These potentially reduced-risk products include Next Generation Products (NGPs), comprising vapour and tobacco heating products (THPs), as well as oral tobacco and nicotine products such as snus and moist snuff.

Since 2012, together with Reynolds American, we have invested approximately US$2.5 billion in the growth of our range of NGPs. We have also significantly increased the size of our existing oral tobacco business with the addition of more snus and moist snuff brands in the US.

Our commitment to leading and accelerating this transformation is also demonstrated by the changes we are making in how we run our business – including our NGP activities being integrated into the heart of the Company across all functions and across all geographies.

While we cannot be certain whether all smokers will switch to potentially reduced-risk products, we are committed to making a range of high-quality, innovative products as widely available as practicable to address the varied preferences of our consumers.

We believe that by doing this, and working with regulators to establish supportive regulatory regimes, many millions of smokers will increasingly make the choice to switch.

This transformation is larger than just BAT. Lasting change will only be achieved by a combination of the commitment and product investment from companies like BAT and the support of regulators through the establishment of sensible regulation promoting a spectrum of potentially reduced-risk products.

We also need the objective and balanced support of public health bodies, politicians, media and academics in driving informed choice and consumer trust.

If we can all work successfully together we can drive a triple win. Our consumers will have a range of potentially safer choices; society could benefit from real progress in tobacco harm reduction; and our shareholders will own an even more sustainable and profitable business.

The investments that we have made are now delivering real, tangible results. Thanks to our commitment, we are now able to provide an unrivalled suite of potentially less harmful products that can address the many and varied preferences of today’s more demanding consumers.

Today, we have industry-leading products in vapour; in tobacco heating products; in oral tobacco (including snus and moist snuff); and in our tobacco-free nicotine pouches. This is just a beginning. We aim for far more.

These smokeless products offer genuine choices to consumers searching for alternatives to traditional cigarettes.

This investment has been driven by our firmly held belief that our consumers are not all the same and so will need a range of different products to meet their varied and constantly evolving preferences.

However, this is just the start. To lead this transformation we must win the technology race, so our R&D investment, led by hundreds of scientists across the world, is predominantly focused on developing our pipeline of potentially reduced-risk products.

All of the progress we have made to date gives us confidence to set clear ambitions for our future.

By the end of 2018 our objective is to generate over £1 billion revenue from NGPs and by 2022 to have increased that figure fivefold to £5 billion.

Taken together with the growing revenue from our oral tobacco business, we fully expect that by 2030, a very significant percentage of Group revenue will be generated by our suite of potentially reduced-risk products.

These aims will not be easy to reach, but, with a combination of commitment and investment, we believe they are achievable.

However, even with these ambitious objectives, it is clear that conventional cigarettes will remain a key part of our business for many years to come and will continue to provide a vital source of investment for our NGPs.

We often get asked why we don’t just stop selling cigarettes? In short, we don’t believe this would be commercially sensible or practical: the ongoing consumer demand for these products would either transfer straight to our competitors or, more worryingly, the black market and in many markets there are still real regulatory obstacles to launching NGPs.

That is why alongside our commitment to the transformation of our business, we also remain fully committed to our combustible tobacco business during this transformation.

Our progress: The Group delivered another year of growth across our key metrics.

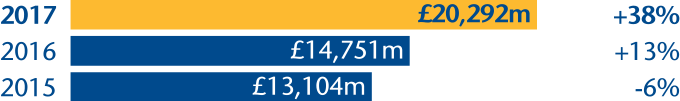

Definition: Revenue recognised, net of duty, excise and other taxes.

Target: A specific target is set each year

Definition: Profit for the year before the impact of net finance costs/income, share of post-tax results of associates and joint ventures and taxation on ordinary activities.

Definition: Change in revenue before the impact of adjusting items and the impact of fluctuations in foreign exchange rates.

Definition: Change in profit from operations before the impact of adjusting items and the impact of fluctuations in foreign exchange rates.

Target: To increase dividend in sterling terms, based upon the Group’s policy to pay dividends of 65% of long‑term sustainable earnings.

Definition: Dividend per share in respect of the financial year

Target: A specific target is set each year

Definition: Free cash flow, excluding restructuring costs, dividends and other appropriations from associates

Definition: Profit attributable to owners of BAT p.l.c. over weighted average number of shares outstanding, including the effects of all dilutive potential ordinary shares.

Definition: Movement in net cash and cash equivalents before the impact of net cash used in financing activities, net cash used in investing activities and differences on exchange.

Definition: Profit from operations as a percentage of revenue.

Definition: Change in diluted earnings per share before the impact of adjusting items.

Definition: Change in adjusted cash generated from operations, as defined on page 222 of the Annual Report and Accounts, before the impact of fluctuations in foreign exchange rates.

Definition: Adjusted profit from operations as a percentage of adjusted revenue.

Definition: Change in diluted earnings per share before the impact of adjusting items and the impact of fluctuations in foreign exchange rates.

Definition: Net cash generated from operating activities as a percentage of profit from operations.

Definition: Operating cash flow, as defined on page 221 of the Annual Report and Accounts as a percentage of adjusted profit from operations. Operating cash flow is not a measure defined by IFRS.

Notes: To supplement our results of operations presented in accordance with IFRS, the information presented also includes several non- GAAP measures used by management to monitor the Group’s performance. See the section Non-GAAP measures beginning on page 218 of the Annual Report and Accounts for information on these non-GAAP measures, including their definitions and reconciliations to the most directly comparable IFRS measure, where applicable. Certain of our measures are presented based on constant rates of exchange, on an adjusted basis and on an organic basis. See the Annual Report for further details.

1. Where measures are presented ‘at constant rates’, the measures are calculated based on a re-translation, at prior year exchange rates, of the current year results of the Group and its segments.

2. Where measures are presented as ‘adjusted’, they are presented before the impact of adjusting items. Adjusting items represent certain items of income and expense which the Group considers distinctive based on their size, nature or incidence.

3. Where measures are presented as ‘organic’ or ‘org’, they are presented before the impact of the contribution of businesses acquired during the year, including Reynolds American, Bulgartabac, Winnington and Fabrika Duhana Sarajevo.

@ denotes table and accompanying text that does not form part of BAT’s Annual Report on Form 20-F as filed with the SEC.

Our strategy remains as relevant today to drive our transforming tobacco ambition as it was when it was first rolled out in 2012. It enables us to deliver growth today while driving the investment required to deliver our transformational agenda.

Our vision remains clear: while combustible tobacco products will remain at the core of our business for some time to come, we understand that long-term sustainability will be delivered by our transforming tobacco ambition.

World’s best at satisfying consumer moments in tobacco and beyond.

Our consumers are at the core of everything we do and our success depends on addressing their preferences, concerns and behaviours.

We know that these are fragmenting and evolving at an unprecedented pace, and consequently, we are focusing on providing a range of tobacco and nicotine products across the risk spectrum. In addition, we are clear that to win in this space we need to understand our consumers’ preferences and further invest in a pipeline of ever evolving innovations.

Delivering our commitments to society, while championing informed consumer choice.

We have long known that, as a major international business, we have a responsibility to address societal issues with our tobacco products, and that, as our business continues to grow, so does our influence and the responsibility that comes with it.

We are also clear that we have a duty to our shareholders to ensure we continue to deliver today and invest for a sustainable future and to our consumers to provide, in addition to our combustible products, a range of potentially reduced-risk products such as NGPs and oral tobacco products.

Our transforming tobacco ambition, with its core objective of providing consumers with more choice, more innovation and less risk will allow us to: satisfy these consumers; address societal concerns at large through the growth of multiple categories of potentially reduced-risk tobacco and nicotine products; and provide a sustainable, profitable future for our shareholders.

Our four key focus areas remain fundamental to our strategy as we focus on our transforming tobacco ambition.

Constantly developing our portfolio of potentially reduced-risk products and new technologies while continuing to drive revenue growth from our traditional combustible products.

Effectively deploying resources between product categories and managing our cost base to release funds for investment.

Ensuring we have great people with the right skill sets in the right teams to drive the transformation of our business.

Ensuring a sustainable business that meets the expectations of all our various stakeholders.

Our Guiding Principles provide clarity about what we stand for. They form the core of our culture and guide how we deliver our strategy.

We value enterprise from all of our employees across the world, giving us a great breadth of ideas and viewpoints to enhance the way we do business. We have the confidence to passionately pursue growth and new opportunities while accepting the considered entrepreneurial risk that comes with it. We are bold and strive to overcome challenges. This is the cornerstone of our success.

We give our people the freedom to operate in their local environment, providing them with the benefits of our scale but also the ability to succeed locally. We always strive to do the right thing, exercising our responsibility to society and other stakeholders. We use our freedom to take decisions and act in the best interest of consumers.

Our corporate culture is a great strength of the business and one of the reasons we have been, and will continue to be, successful. We are forward-looking and anticipate consumer preferences, winning with innovative, high-quality products. We listen to, and genuinely consider, other perspectives and changing social expectations. We are open to new ways of doing things.

Our management population comprises people from over 140 nations, giving us unique insights into local markets and enhancing our ability to compete across the world. We respect and celebrate each other’s differences and enjoy working together. We harness diversity – of our people, cultures, viewpoints, brands, markets and ideas – to strengthen our business. We value what makes each of us unique.

Argentina, Brazil, Canada, Chile, Colombia, Mexico

Belgium, Czech Republic, Denmark, France, Germany, Italy, Netherlands, Poland, Romania, Spain, Switzerland, United Kingdom

British American Tobacco is a leading, multi-category consumer goods company that provides tobacco and nicotine products to millions of consumers around the world.

With market leadership in over 55 countries and cigarette factories in 42 we have genuine global reach. Our world-class portfolio of cigarette brands is complemented by our increasing range of potentially reduced-risk products. This includes our Next Generation Products, comprising our vapour and tobacco heating products, and our oral tobacco and nicotine products such as moist snuff and snus.

Following the acquisition of leading brands in the US, as well as the growing importance and progress of our potentially reduced‑risk products, we have established a portfolio of priority brands – our Strategic Portfolio – to replace the Global Drive Brands (Dunhill, Kent, Lucky Strike, Pall Mall and Rothmans).

BAT is a truly global consumer goods company with brands sold in over 200 markets. In 2017, we had strong market positions in each of our five regions*, outlined here.

We have one principal associate company – ITC Ltd in India – and we also have a joint operation, CTBAT, with China National Tobacco Corporation.

* As of 1 January 2018, the Group’s International regional structure (ex US) was reduced to three regions comprising: Americas and Sub-Saharan Africa; Europe and North Africa; and Asia-Pacific and Middle East.

Our Strategic Portfolio, as set out below, reflects our priority to provide consumers with a range of potentially reduced-risk products while recognising the important role that our combustible brands play in delivering ongoing value for shareholders and the funds required to invest further in our Next Generation Products.

We also have many international and local cigarette brands which, although not part of our Strategic Portfolio, play an important role in delivering the Group’s strategy in a number of Key Markets.

At the centre of our global business, operating in over 200 markets, is the manufacture and marketing of superior combustible tobacco products and potentially reduced-risk products – this includes our Next Generation Products (NGPs), comprising vapour and tobacco heating products (THPs), alongside oral tobacco and nicotine products such as moist snuff and snus.

Our sustainable approach to sourcing, production, distribution and marketing helps us to create value for a wide group of stakeholders, from farmers to consumers.

We use our unique strengths and employ our resources and relationships to deliver sustainable growth in earnings for our shareholders.

We employ over 55,000 people worldwide, with a workforce that is diverse and multicultural.

We have a devolved structure, with each local company having responsibility for its operations.

We employ over 55,000 people worldwide, with a workforce that is diverse and multicultural.

We have a devolved structure, with each local company having responsibility for its operations.

The quality of our people is a major reason why the Group continues to perform well. In return, we commit to investing in our people as we do in our brands.

We encourage a culture of personal ownership and we value our employees’ talents and abilities. Their diverse perspectives help us to succeed.

We also have excellent relationships with a range of stakeholders, including farmers, retailers and distributors.

We engage with regulators around the world to support regulation that is based on robust evidence and thorough research, that respects legal rights and livelihoods, and delivers on the intended policy aims while recognising unintended consequences.

We make significant investments in research and development to deliver innovations that satisfy or anticipate consumer preferences and generate growth for the business across all categories.

We make significant investments in research and development to deliver innovations that satisfy or anticipate consumer preferences and generate growth for the business across all categories. The main focus of this investment is in our NGPs, such as vapour and THPs. Since 2012, together with Reynolds American, we have invested over US$2.5 billion in the development and commercialisation of potentially lower risk alternatives to smoking. We also conduct R&D into our conventional cigarette innovations such as capsule products, additive-free products, slimmer products, tube filters and Reloc, our resealable pack technology.

We have an extensive scientific research programme in a broad spectrum of scientific fields including molecular biology, toxicology and chemistry. We are transparent about our science and publish details of our research programmes on our dedicated website, www.bat-science.com, and the results of our studies in peer-reviewed journals.

While the Group does not own tobacco farms or directly employ farmers, we buy more than 400,000 tonnes of tobacco each year for our combustible tobacco products, our oral tobacco products and our THPs.

We manufacture high-quality products in manufacturing facilities all over the world. We also ensure that these products and the tobacco leaf we purchase are in the right place at the right time. Our NGPs are manufactured in a mix of our own and third-party factories. We work to ensure that our costs are globally competitive and that we use our resources as effectively as possible.

We offer adult consumers a range of products, including cigarettes; Fine Cut tobacco; snus; moist snuff; vapour; and THPs in a number of markets around the world. Our range of high-quality products covers all segments, from value-for-money to premium.

We distribute our products around the globe effectively and efficiently using a variety of different distribution models suited to local circumstances and conditions. Around half of our global cigarette volume is sold by retailers, supplied through our direct distribution capability or exclusive distributors. We continuously review our route to market for combustible products, oral tobacco products and NGPs, including our relationships with wholesalers, distributors and logistics providers.

We place consumers at the centre of our business. We invest in world-class research to understand changing consumer preferences and buying behaviour. This drives our leaf sourcing, product development, innovations, brands and trade activities.

We aim to satisfy consumers with a range of inspiring products across the risk spectrum and address expectations about how we should market them.